NORD supports the Affordable Care Act (ACA) and its requirements that health insurers offer comprehensive plans with strong patient protections and opposes efforts to expand access to short-term, limited duration health plans.

The ACA established a range of critical protections for individuals living with rare diseases, including prohibiting insurers from denying an individual coverage because of a pre-existing condition, charging an individual more because of their health status, or excluding certain benefits in order to discourage those with complex health conditions from enrolling in their plans. The ACA also established new health care marketplaces, or exchanges, to help secure affordable health insurance for all Americans and establish a minimum standard of quality for all plans.

Unfortunately, the Trump Administration took various actions to destabilize the ACA by making numerous changes to the rules governing the health insurance marketplaces. This allowed states to weaken their essential health benefits and network adequacy requirements, as well as allow for the expanded use of short-term, limited duration health plans and association health plans.1

Rare disease patients need affordable and comprehensive health insurance benefits to treat their conditions and keep them healthy. In order for the health care costs of those with complex health conditions to remain affordable and sustainable, there must be significantly more people without complex health conditions participating in the same health care system. Since healthier individuals are more likely to choose to participate in plans that offer cheaper, but less comprehensive coverage, the proliferation of short-term, limited-duration health plans results in healthier individuals with fewer routine health care needs segmenting themselves into a separate risk pool. This leaves those with more complex health conditions bearing the brunt of higher health insurance costs.

Additionally, some individuals enroll in a short-term, limited-duration health plan with the impression that the short-term plan will cover the same benefits as a comprehensive plan, only to discover after an unexpected health issue that their coverage does not include many of the essential benefits they now need covered.

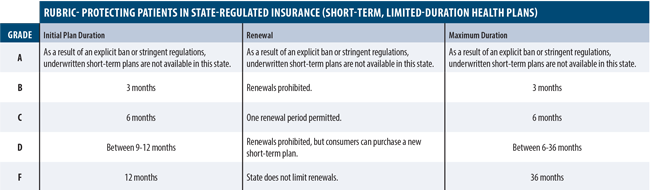

NORD’s State Report Card includes information on what actions, if any, states have taken to protect access to affordable comprehensive health care plans and mitigate the expansion of short-term, limited-duration health plans. States were graded separately on the following three categories, and an overall grade for short-term, limited duration health plans was determined by taking the average of these three separate grades; more information on each state can be found in the appendices.

Click to enlarge